When you hear the word “premium,” you might think of insurance, memberships, or high-end services. But in the world of trading, especially in the options market, “option premium” means something completely different.

When trading in the stock market, options are a popular tool that allow you to profit from price movements without actually buying the stock. But to use options, you need to pay something called an option premium.

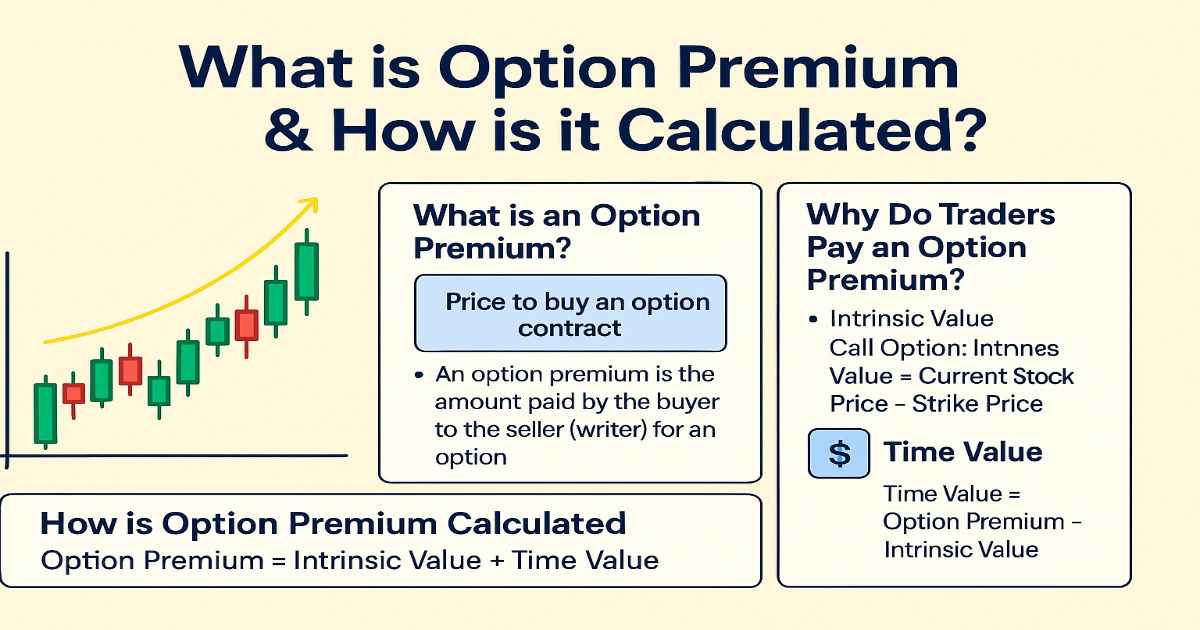

In simple terms, option premium is the price you pay to buy an option contract. It gives you the right to buy or sell a stock at a fixed price in the future. Just like you pay a premium for insurance, you also pay a premium when you buy an option — because it gives you special rights.

What is an Option Premium?

An option premium is the price you pay to buy an option contract.

When you buy an option — whether it’s a Call (right to buy) or a Put (right to sell) — you are not buying the actual stock. You are buying the right to buy or sell that stock at a fixed price (called strike price) on or before a certain date (expiry date).

Why Do Traders Pay an Option Premium?

Think of it like buying insurance. You’re paying for protection or a potential opportunity.

Example:

You think Stock A might go up. Instead of buying the stock directly, you buy a call option. That option gives you the right to buy the stock at today’s price even if the market goes higher — and you pay a premium for that privilege.

If the stock goes up, great — your option gains value. If not, your loss is limited to the premium you paid. That’s why traders are willing to pay it — for leverage, flexibility, and limited risk.

Option Premium Meaning

Option Premium is the price paid by the buyer to purchase an option contract.

In options trading, you don’t directly buy or sell stocks — you buy the right to do so at a specific price in the future. This right comes at a cost, and that cost is called the option premium.

- It is paid upfront by the buyer

- It is received by the seller (also called the writer)

The premium reflects what the market thinks the option is worth, based on factors like stock price, time left to expiry, volatility, and more.

Special Considerations for Options Pricing

While the basic formula for option pricing includes intrinsic value + time value, there are some special factors that can significantly influence how options are priced in real market conditions. Let’s look at them:

Volatility (Implied Volatility)

- Higher volatility = Higher premium

- When a stock is more volatile, there’s a greater chance it could make a big move — and that increases the value of the option, especially the time value.

- Even if the stock doesn’t move much yet, the expectation of movement increases the premium.

Example: Options on Nifty tend to have lower premiums than options on highly volatile stocks like Adani Enterprises.

Time to Expiry (Time Decay)

- The more time left until expiry, the higher the time value — which means a higher premium.

- As expiry gets closer, time value drops, a process called Theta decay.

Options lose value faster as they get closer to the expiry date, especially in the last week.

Interest Rates

- Interest rates can affect option pricing, especially in longer-duration options.

- When interest rates go up, call option premiums may increase slightly, and put option premiums may decrease.

Though the effect is small, it can matter in large portfolios or long-term options.

Dividends

- If a stock is expected to pay a dividend before option expiry, it can affect the premium:

- Call options tend to become cheaper

- Put options become slightly more expensive

This happens because the stock price may fall by the dividend amount on the ex-dividend date.

Demand and Supply

- Like any other market product, options are also driven by demand and supply.

- If more traders are buying a particular option, its premium can rise — regardless of the theoretical value.

This is why real-time option prices often differ slightly from calculated values.

| Factor | Effect on Premium |

|---|---|

| Volatility ↑ | Premium ↑ |

| Time to Expiry ↑ | Premium ↑ |

| Interest Rate ↑ | Call ↑, Put ↓ |

| Dividend Expected | Call ↓, Put ↑ |

| High Demand | Premium ↑ (may exceed fair value) |

How Is Option Premium Calculated?

The option premium is calculated based on two main components:

Intrinsic Value

This is the real value of the option — how much it’s already in profit.

- Call Option:

Intrinsic Value = Current Market Price – Strike Price - Put Option:

Intrinsic Value = Strike Price – Current Market Price

If the result is negative, the intrinsic value is taken as zero.

Time Value

This is the extra value based on the time left until expiry and the expected price movement (volatility).

- More time = Higher time value

- More volatility = Higher time value

Option Premium Formula:

Option Premium = Intrinsic Value + Time Value

Example of Option Premium Calculation

Let’s say:

- Stock Price = ₹1,000

- Strike Price = ₹970 (Call Option)

- Premium = ₹50

Step 1: Intrinsic Value = ₹1,000 – ₹970 = ₹30

Step 2: Time Value = ₹50 – ₹30 = ₹20

So, ₹50 premium includes:

- ₹30 intrinsic value (actual benefit right now)

- ₹20 time value (possibility of future gain)

How to Use Option Premium in Trading Strategy

Understanding the option premium isn’t just theory — it’s a powerful tool that can help you plan smarter trades. Here’s how you can use option premium effectively in your trading strategy:

1. Buying Options (Call or Put)

When you buy an option, the maximum loss is the premium paid, and your potential profit can be high.

🔹 Buy Call Option – If you expect the stock to go up

🔹 Buy Put Option – If you expect the stock to go down

Use this strategy when you expect a strong move in the stock and want low risk.

2. Selling Options (Writing)

When you sell an option, you receive the premium upfront, but you take on more risk if the trade goes against you.

🔹 Sell Call Option – If you think the stock won’t rise much

🔹 Sell Put Option – If you think the stock won’t fall much

Use this when markets are sideways or you’re happy with small, consistent returns.

Where to Find Option Premium in India?

If you’re trading options in India, finding the option premium (the price of the option) is quick and easy. You can view real-time option premiums on multiple platforms. Here’s how:

1. NSE India Website (Official)

- Go to: https://www.nseindia.com

- Search for your stock (e.g., Reliance, Nifty, Bank Nifty)

- Click on the “Option Chain”

- You’ll see a table showing:

- Strike prices

- Call & Put premiums

- Volumes, open interest, and more

This is the most reliable and official source for real-time option data in India.

2. Brokerage Platforms & Apps

Most trading apps and platforms show live option premiums:

| Platform | Features |

|---|---|

| Zerodha Kite | Option chain, charts, Greeks |

| Upstox | Easy UI, live premiums, strategy tools |

| Angel One | Option trading dashboard, filters |

| Groww / Paytm | Beginner-friendly, basic option details |

You just need to enter the stock/index name and select the “F&O” section or Option Chain.

3. Market Data Websites

Websites like:

- Sensibull (https://sensibull.com)

- Opstra (https://opstra.definedge.com)

- Moneycontrol

- Economic Times Markets

offer clean and interactive option chain tools, showing live premiums, strategies, and Greeks.

Option Premium vs Stock Price

| Feature | Option Premium | Stock Price |

|---|---|---|

| What is it? | Price to buy an option contract | Price to buy 1 share of the company |

| Purpose | To gain the right (not obligation) to buy/sell stock | To own a part of the company |

| Cost | Much lower than stock price | Usually higher, depending on the stock |

| Value Over Time | Decreases with time decay | Changes with market performance |

| Expiry | Has an expiry date | No expiry — you can hold as long as you want |

| Risk/Reward | Limited risk (only premium lost) | Full amount at risk unless stop-loss applied |

Tax on Option Premiums in India (FY 2025)

In India, income from options trading (both buying and selling) is considered a business income, not capital gains. So, taxes on option premiums fall under Income Tax on Business Income.

| Scenario | Tax Treatment |

|---|---|

| Selling an Option | Premium received = Business Income |

| Buying an Option | Premium paid = Business Expense (if the option expires worthless) |

| Profit from Option Trade | Taxed as Business Profit |

| Loss from Option Trade | Treated as Business Loss |

Example:

You sell a Call Option and receive ₹5,000 as premium.

This ₹5,000 is considered income under “profits and gains from business or profession”.

If you bought an option for ₹3,000 and it expired worthless, you can claim it as a business loss.

- Audit Required if turnover exceeds ₹10 crore (with digital transactions)

- File ITR-3 if you are an individual trader

- You can deduct expenses (internet, broker fees, software, etc.) from profits

- Set off & carry forward: Business losses from options can be carried forward up to 8 years

If you’re actively trading options, treat it like a business — maintain records, file accurate returns, and consult a tax advisor to avoid penalties.

Conclusion

Understanding option premium is a must for anyone who wants to trade options confidently.

It’s not just a price — it reflects the value of an option, based on time, volatility, and market expectations. Whether you’re buying or selling options, knowing how premiums work helps you make smarter decisions, manage risk better, and build effective trading strategies.

From calculating the premium to using it in trades, and even knowing how it’s taxed — you now have a solid foundation to get started.

FAQs

What is theta decay?

Theta decay is the rate at which an option’s premium decreases as time passes. As the expiration date approaches, the time value decreases, leading to a decline in premium.

What is option premium in simple terms?

An option premium is the price you pay to buy an option contract. It’s like a ticket fee to get the right to buy or sell a stock at a certain price before a certain date.

Is option premium taxed in India?

Profits from buying or selling options are taxed under business income. You must report it while filing your income tax return using ITR-3.

How do I calculate the option premium?

The option premium is typically calculated using complex mathematical models. However, many online platforms and brokerage tools offer calculators that can help you estimate this premium.

Why is options premium important?

The options premium is the heart of options trading. It tells you the actual cost of an options contract and plays a key role in deciding whether a trade is profitable or not.

Disclaimer

This article is for educational and informational purposes only. Trading in options and derivatives involves high risk and may not be suitable for all investors. Readers are advised to do their own research and consult with a SEBI-registered financial advisor before making any investment or trading decisions.