Algorithmic trading — often called algo trading — has revolutionized the way markets operate. From Wall Street hedge funds to independent retail traders, algorithms are driving a large portion of daily trades across stocks, forex, commodities, and cryptocurrencies.

A report by MarketandMarkets estimates the global algorithmic trading market will reach $20 billion by 2026, growing at over 11% annually. The reason is simple — algorithms can trade faster, more consistently, and without emotions compared to humans.

What is a Trading Algorithm?

A trading algorithm is a set of rules or instructions programmed into software to automatically execute trades based on predefined criteria. These criteria can include price, volume, technical indicators, or even news sentiment.

In simple terms:

You give your computer the trading plan, and it trades for you.

For example:

If the 50-day moving average crosses above the 200-day moving average, buy 100 shares of XYZ stock.

If the reverse happens, sell them.

The system works automatically without you manually clicking buy/sell buttons.

Benefits of Using a Trading Algorithm

Before diving into the steps, let’s quickly look at why algo trading is so widely adopted.

- Emotion-Free Decisions

Eliminates fear, greed, and overconfidence from trading decisions. - High-Speed Execution

Orders can be executed in milliseconds — crucial in fast-moving markets. - Backtesting

You can test strategies on historical data before risking real money. - Multi-Market Monitoring

An algo can watch hundreds of stocks, currencies, or cryptos at once. - Consistency

Trades exactly as programmed — no deviations or second-guessing.

Core Components of a Trading Algorithm

Before building one, you need to understand its main building blocks:

| Component | Function |

|---|---|

| Data Feed | Real-time and historical market data. |

| Strategy Logic | The trading rules to follow. |

| Execution System | Sends orders to the broker/exchange. |

| Risk Management | Controls losses and position sizes. |

| Performance Metrics | Tracks profitability, accuracy, and drawdowns. |

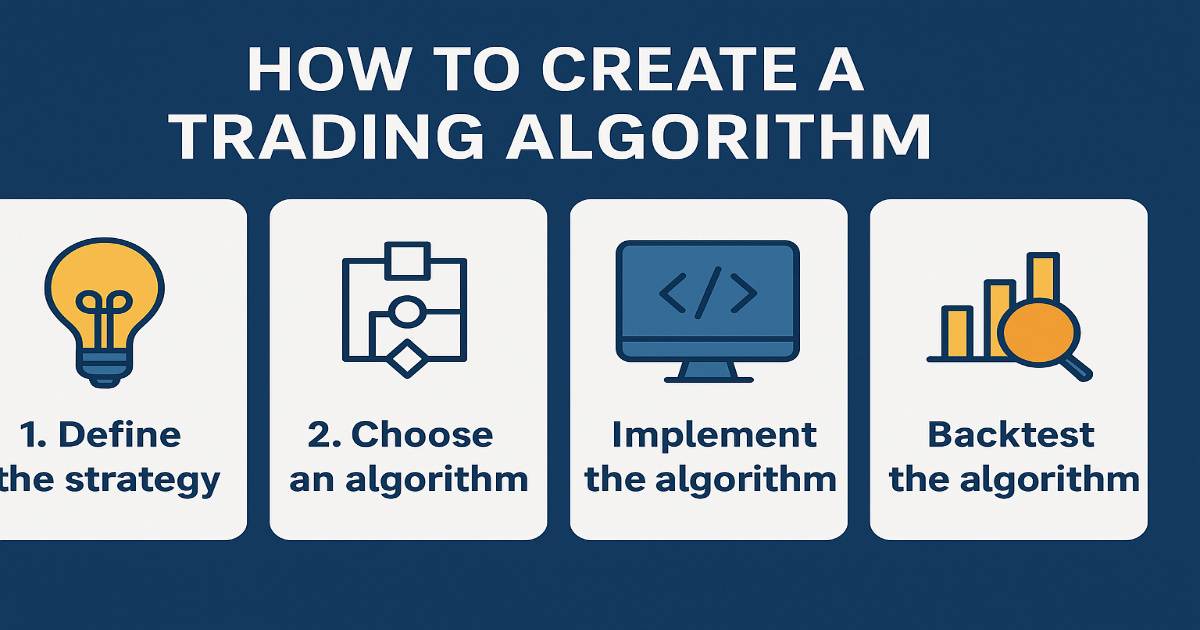

Create a Trading Algorithm

Step 1: Define Your Trading Objective

Your first step is clarity — decide what you want to achieve.

Questions to ask:

- What market do I want to trade? (Stocks, Forex, Crypto, Commodities)

- What’s my preferred time frame? (Scalping, Intraday, Swing, Long-term)

- How much capital am I starting with?

- Am I comfortable with high risk, or do I want stable returns?

Example Objective:

“I want to build a swing trading algorithm for the Nifty 50 stocks in India, aiming for 12–15% annual returns with less than 10% drawdown.”

Step 2: Choose Your Trading Strategy

Your strategy is the heart of your algorithm. Some popular ones include:

1. Trend Following

- Buy when prices are rising, sell when they’re falling.

- Example: Moving Average Crossovers — when a short-term average crosses above a long-term one, it signals a buy.

2. Mean Reversion

- Prices eventually revert to their average.

- Example: Buy when the price dips far below the average (Bollinger Bands), sell when it’s far above.

3. Breakout Trading

- Trade strong price moves after breaking key support/resistance levels.

4. Arbitrage

- Exploit price differences between two markets or exchanges.

5. Statistical/Machine Learning Models

- Use AI or statistics to predict price movements.

Step 3: Select a Programming Language

The most popular languages for algorithmic trading are:

- Python – Best for beginners, rich in data analysis libraries like Pandas, NumPy, TA-Lib, Backtrader.

- R – Great for statistical analysis and backtesting.

- C++ – Used for high-frequency trading due to speed.

- Java/JavaScript – Often used for web-based trading platforms.

If you’re starting, Python is your best bet — easy to learn, widely supported.

Step 4: Collect and Clean Historical Data

You’ll need both historical data for backtesting and real-time data for live trading.

Data Sources:

- Yahoo Finance – Free stock data.

- Alpha Vantage – Free API with limited calls.

- Quandl – Free & paid data.

- Broker APIs – Direct, reliable, and often real-time.

Cleaning Data Includes:

- Removing bad or missing data points.

- Adjusting for splits/dividends.

- Making sure time zones match.

Step 5: Write Your Strategy Logic

Let’s use a Moving Average Crossover Strategy as an example.

Idea:

- Buy when the 50-day SMA crosses above the 200-day SMA.

- Sell when the 50-day SMA crosses below the 200-day SMA.

Python Example:

import pandas as pd

import yfinance as yf

# Download data

data = yf.download("AAPL", start="2020-01-01", end="2025-01-01")

data['SMA50'] = data['Close'].rolling(50).mean()

data['SMA200'] = data['Close'].rolling(200).mean()

# Generate signals

data['Signal'] = 0

data.loc[data['SMA50'] > data['SMA200'], 'Signal'] = 1

data.loc[data['SMA50'] < data['SMA200'], 'Signal'] = -1

Step 6: Integrate Risk Management

Risk management is the life jacket of your trading system.

Best practices:

- Risk only 1–2% of your capital per trade.

- Use stop-loss orders to cap losses.

- Use take-profit levels to secure gains.

- Set a max daily or weekly loss limit to avoid overtrading.

Step 7: Backtest the Strategy

Backtesting means running your strategy on past data to see how it would have performed.

Key Metrics to Check:

- CAGR – Compound Annual Growth Rate.

- Win Rate – Percentage of profitable trades.

- Max Drawdown – Largest loss from peak equity.

- Sharpe Ratio – Return per unit of risk.

Tools for Backtesting:

- Backtrader (Python)

- Zipline (Python)

- QuantConnect (Cloud-based)

Step 8: Optimize Without Overfitting

Optimization means adjusting parameters (like SMA length) to improve performance.

But beware of overfitting — making your algo too perfect for past data but useless for future markets.

Tips:

- Use out-of-sample testing — test on data not used for optimization.

- Keep strategy rules simple.

- Avoid chasing perfect backtest results.

Step 9: Paper Trade

Before risking money, run your algo in paper trading mode — a simulated environment with live data but no real capital.

Benefits:

- Test execution speed.

- Ensure broker API works properly.

- Check if results match backtesting.

Step 10: Deploy Live

When you’re confident, connect your algorithm to a broker’s API:

- Interactive Brokers API – Global markets.

- Alpaca API – Commission-free US stock trading.

- Binance API – Crypto trading.

- Zerodha Kite API – Indian stock market.

Important:

- Use a VPS (Virtual Private Server) for uninterrupted trading.

- Set up error-handling in your code.

- Enable email/SMS alerts for unusual activity.

Backtest Results of a Simple Strategy

Let’s say we backtested the SMA Crossover Strategy on Apple stock from 2015–2024.

Results:

- CAGR: 14.2%

- Win Rate: 54%

- Max Drawdown: 18%

- Sharpe Ratio: 1.3

These results are decent, but real-world performance may differ due to slippage, commissions, and latency.

Common Mistakes in Algo Trading

- Overfitting to Past Data – Looks perfect in backtests but fails live.

- Ignoring Costs – Trading fees and spreads reduce profits.

- Too Complex – More rules don’t always mean better results.

- Poor Risk Control – Even good strategies fail without proper risk limits.

- Set-and-Forget Mindset – Algos need regular monitoring.

Advanced Tips for Serious Traders

- Use Multiple Time Frames – Confirm trades with higher time frames.

- Add Position Sizing Logic – Increase size in strong trends.

- Use Cloud Platforms – QuantConnect, MetaTrader VPS hosting.

- Incorporate AI – Machine learning for predicting market moves.

- Portfolio Approach – Run multiple strategies to diversify risk.

Conclusion

Building a trading algorithm is a bit like training a really smart assistant — you teach it the rules, give it the right tools, and then trust it to do the job. The magic happens when you combine a solid strategy, clean data, and smart risk management. That’s when your algorithm can trade consistently without being swayed by emotions like fear or greed.

But here’s the truth: no algorithm is “set it and forget it.” Markets change, trends shift, and what works today might need tweaking tomorrow. That’s why the best traders treat their algorithms like living projects — testing them, fine-tuning them, and keeping an eye on their performance.

If you approach it with patience, discipline, and a willingness to adapt, your trading algorithm can become one of your most valuable tools — helping you trade smarter, faster, and with a lot less stress.

Frequently Asked Questions (FAQs)

Do I need to be a programmer to create a trading algorithm?

Not necessarily. While coding gives you more flexibility, there are many no-code platforms like Tradetron, AlgoTrader, and MetaTrader where you can build algorithms using visual tools. However, learning basic Python can open up far more possibilities.

Can a trading algorithm guarantee profits?

No — and anyone claiming otherwise is selling a dream. Algorithms can improve consistency and remove emotions, but they still face market risks, unexpected volatility, and technical failures.

How much money do I need to start algo trading?

It depends on the market and your broker. In crypto, you can start with as little as $50–$100. For stocks, brokers may require higher amounts, often $500–$2000, depending on margin rules.

Which markets are best for algorithmic trading?

Algo trading works in stocks, forex, commodities, and crypto. The best market for you depends on your knowledge, time zone, and capital. Many beginners start with liquid markets like major forex pairs or large-cap stocks.

How do I test my trading algorithm before going live?

You can backtest it using historical data, then run it in paper trading mode (demo mode) with real-time market data but no real money. This helps you see how it performs without financial risk.

Do I need expensive software to get started?

No. Python, Backtrader, QuantConnect, and many broker APIs are free. You can start with open-source tools and upgrade as your needs grow.

What’s the biggest mistake beginners make in algo trading?

Overfitting — designing an algorithm that works perfectly on past data but fails in the real world. Keep your strategy simple and test it on fresh data.