Health shocks happen. A single hospital stay can wipe out years of savings if you’re not covered. That’s why health insurance is not an optional “extra” — it’s a financial planning essential. This guide will walk you through everything: why to buy, what types exist, how to compare plans, what to watch for in terms and exclusions, tax benefits, and practical steps to buy and file claims.

What is Health Insurance Policy?

A Health Insurance Policy is a financial product designed to protect you against unexpected medical expenses. In simple terms, it is an agreement between you (the policyholder) and an insurance company, where the insurer promises to cover certain medical costs—such as hospitalization, surgeries, medicines, and other healthcare services—in exchange for a premium you pay regularly (monthly, quarterly, or annually).

In India, health insurance has become a crucial financial safety net because of rising healthcare costs. Without it, a single medical emergency can drain years of savings.

Example

If you buy a health insurance policy with a sum insured of ₹10 lakh and get hospitalized for a surgery costing ₹4 lakh, the insurance company will pay the hospital bill (as per policy terms). You only need to bear non-covered expenses like registration fees, luxury room charges, or specific exclusions.

Why We Need Health Insurance

In today’s fast-paced life, health insurance has become more than just a financial product—it is a necessity for every individual and family. Medical costs in India are rising at an alarming rate due to inflation, advanced treatments, and growing lifestyle-related diseases. Without a health insurance plan, one unexpected illness or accident can wipe out years of savings and create a huge financial burden.

1. Rising Medical Costs

- Hospitalization charges, doctor fees, diagnostic tests, and medicines have all seen a sharp rise in the last decade.

- For example, a bypass surgery in a good hospital can cost between ₹3–₹5 lakhs, while a single day in an ICU may cost ₹10,000–₹20,000.

- Health insurance helps you pay these bills without disturbing your financial stability.

2. Protection Against Lifestyle Diseases

- Diseases like diabetes, heart problems, hypertension, and cancer are becoming more common—even among young people.

- Treatment for such illnesses often requires long-term care and high expenses.

- A health insurance plan covers these costs, ensuring you can focus on recovery rather than worrying about money.

3. Cashless Hospitalization

- Most insurers have network hospitals where you can get treated without paying cash upfront.

- The insurance company directly settles the bill with the hospital, reducing stress during emergencies.

4. Financial Security for the Family

- In case the primary earning member falls sick or meets with an accident, medical bills can drain savings and disrupt the family’s lifestyle.

- Health insurance ensures your family’s well-being is not compromised.

5. Coverage for Pre- and Post-Hospitalization

- Good health insurance plans cover expenses even before and after hospitalization, including diagnostic tests, follow-up visits, and medicines.

6. Tax Benefits

- Premiums paid for health insurance qualify for tax deductions under Section 80D of the Income Tax Act.

- This means you not only secure your health but also save money on taxes.

What Exactly Is Health Insurance?

A health insurance plan is an agreement between you and the insurance company where:

- You pay a premium every year.

- The insurer pays for medical expenses when you fall sick, get injured, or require hospitalization (up to the sum insured).

Key Benefits at a Glance

- Cashless Treatment — No need to pay upfront at network hospitals.

- Coverage for Family Members — Spouse, kids, and sometimes parents.

- Tax Savings — Premiums qualify for deductions under Section 80D.

- Value-Added Services — Annual check-ups, tele-consultations, wellness rewards.

Why Investing in Health Insurance Makes Financial Sense

1 Protection Against Medical Inflation

Medical costs in India rise 10–15% annually, faster than general inflation. What costs ₹2 lakh today may cost ₹5 lakh in 7–8 years.

2 Prevents Debt & Asset Liquidation

Without insurance, families often sell assets, dip into fixed deposits, or borrow at high interest to pay hospital bills.

3 Encourages Preventive Care

Many insurers offer free annual check-ups, helping detect health issues early.

4 Provides Peace of Mind

Knowing you’re financially prepared allows you to focus on recovery rather than bills.

Why Is Health Insurance Important?

Medical emergencies can have a negative impact on your financial planning and you have to dig deep or sell belongings to provide the best healthcare for yourself or your family members. Health insurance provides financial stability while giving you peace of mind you can get the right treatment when you or your loved one needs it.

Types of Health Insurance Plans in India

Choosing the right type is crucial — here are the main options:

1 Individual Health Insurance

- Covers a single person.

- Dedicated sum insured.

- Example: ₹5 lakh cover for yourself alone.

Best For: Singles or individuals with higher personal health risks.

2 Family Floater Health Insurance

- One sum insured shared among all family members.

- Example: ₹10 lakh cover for self, spouse, and two kids.

Best For: Young families with low medical claim history.

3 Senior Citizen Health Plans

- Designed for people aged 60+.

- May have co-pay clauses but offer higher cover for age-related illnesses.

Best For: Retired parents or elderly family members.

4 Group Health Insurance

- Offered by employers.

- Premium often paid by the company.

- Ends when you leave the job.

Best For: Employees as a base cover (but supplement with personal cover).

5 Critical Illness Insurance

- Lump sum payout upon diagnosis of illnesses like cancer, heart attack, kidney failure.

- Money can be used for treatment or income replacement.

Best For: Those with family history of critical diseases.

6 Top-Up and Super Top-Up Plans

- Kicks in after your base policy threshold is crossed.

- Example: A ₹5 lakh top-up with ₹5 lakh deductible gives total ₹10 lakh cover at lower premium.

Best For: Increasing cover without high costs.

7 Government Schemes

- Ayushman Bharat PM-JAY: ₹5 lakh per family per year for low-income households.

- State-specific schemes: E.g., Arogya Karnataka, Mahatma Jyotiba Phule Jan Arogya Yojana.

Best For: Eligible low-income households.

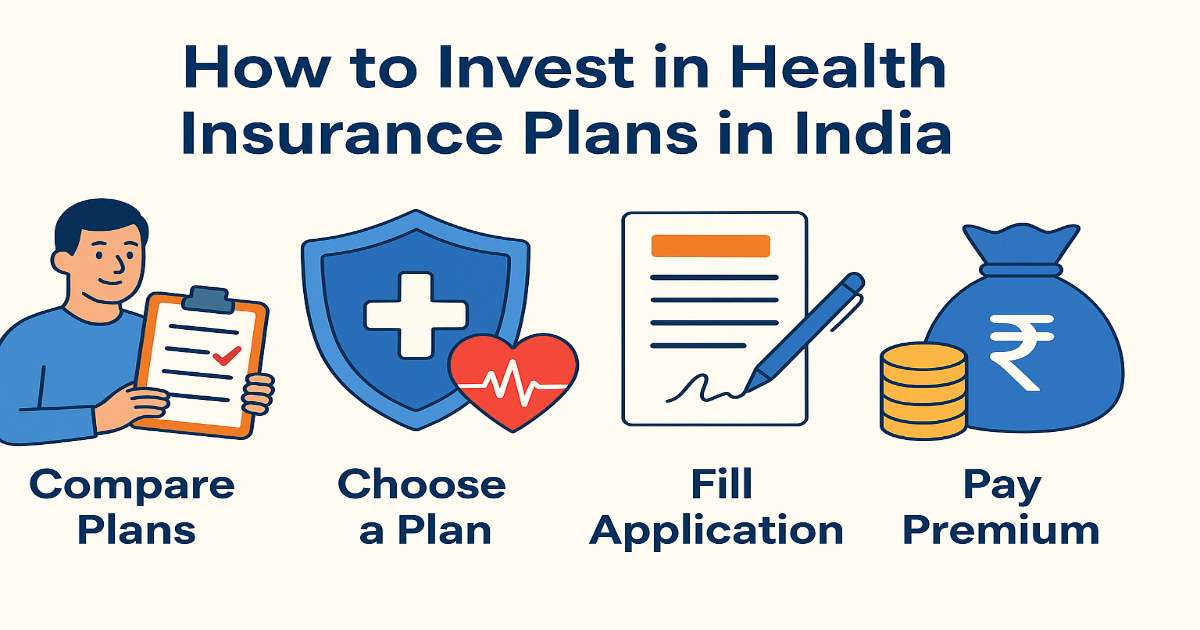

How to Choose the Right Plan

- Identify Needs

- Number of members, ages, health history.

- Decide Sum Insured

- Consider city, inflation, and risk factors.

- Shortlist Plans

- Look beyond premiums — focus on benefits.

- Compare Network Hospitals

- Prefer insurers with multiple options nearby.

- Check CSR & Reviews

- Avoid insurers with poor claim handling.

- Read Policy Wordings

- Understand what’s not covered.

- Buy Early

- Lower premiums and fewer medical tests.

Tax Benefits Under Section 80D

| Who is Covered | Deduction Limit |

|---|---|

| Self & Family (<60 years) | ₹25,000 |

| Parents (<60 years) | ₹25,000 |

| Senior Citizens (Self/Parents) | ₹50,000 |

Example Calculation:

If you’re 35 and parents are 65:

- Self & family: ₹25,000 deduction

- Parents: ₹50,000 deduction

Total = ₹75,000 tax deduction

Quick Pre-Purchase Checklist

- Sufficient sum insured.

- Lifelong renewability.

- No restrictive sub-limits.

- Wide hospital network.

- High CSR.

- Understand exclusions.

Final Thoughts

Health insurance is no longer a luxury in India — it’s a necessity. With medical costs rising at double-digit rates, a single hospitalization can wipe out years of savings. A well-chosen health insurance policy not only provides financial protection but also ensures timely access to quality healthcare without worrying about bills.

The key is to start early, compare smartly, and review regularly. By purchasing a plan when you are young and healthy, you can enjoy lower premiums, fewer exclusions, and better coverage options. Also, remember that health insurance should not just be about tax benefits; it should be about safeguarding your health and your family’s well-being.

Whether you’re a first-time buyer or upgrading your existing policy, always prioritize:

- Adequate coverage amount to match your lifestyle and healthcare inflation.

- Wide hospital network for cashless treatment across the country.

- Transparent terms with minimal hidden clauses.

Ultimately, a health insurance plan is like a safety net — you hope you never have to use it, but when life throws unexpected challenges, it can be the lifeline that keeps your finances intact and your mind at peace. In India’s fast-changing healthcare landscape, making the right investment in health insurance today is one of the smartest decisions for a secure tomorrow.

Frequently Asked Questions (FAQs) About Health Insurance in India

What is the minimum age to buy a health insurance policy in India?

Most insurers offer health insurance for individuals as young as 18 years. For children, coverage can start from as early as 90 days under a family floater plan.

Should I buy health insurance even if I have corporate medical coverage?

Yes. Corporate insurance may have limited coverage, and you may lose it if you change jobs. A personal policy ensures continuous protection regardless of your employment status.

What is a cashless claim facility in health insurance?

In a cashless facility, the insurer directly settles the hospital bill with the network hospital, so you don’t have to pay upfront (except non-covered expenses).

How much health insurance coverage should I have?

Experts recommend at least ₹10–15 lakh coverage for urban residents, considering rising healthcare costs. For families, a family floater plan of ₹20 lakh+ is ideal.

Can NRIs buy health insurance in India?

Yes. Many insurers offer health plans to Non-Resident Indians (NRIs), but claims can be made only for treatments taken in India unless it’s an international coverage plan.

What happens if I don’t renew my policy on time?

If you miss the renewal grace period (usually 15–30 days), your policy will lapse, and you may lose benefits like no-claim bonus and waiting period credits.