These books have shaped the way millions of people understand and invest in the stock market. Whether you’re just starting out or already investing, these books offer timeless strategies, practical wisdom, and proven methods.

Top 5 stock market books for beginners india

1. The Intelligent Investor – Benjamin Graham

About:

Known as the “Bible of Value Investing”, this book teaches how to protect your capital and make rational decisions during market ups and downs. It’s focused on long-term, disciplined investing.

Best For:

Beginners, long-term investors, and those who want to avoid emotional investing.

Key Idea:

Invest with a margin of safety and avoid getting influenced by market noise (Mr. Market concept).

2. Common Stocks and Uncommon Profits – Philip Fisher

About:

A deep dive into growth investing, this book emphasizes understanding a company’s future potential, management quality, and innovation.

Best For:

Investors interested in long-term growth stocks, especially in the tech and innovation space.

Key Idea:

Use qualitative analysis to pick companies that can grow for decades.

3. One Up On Wall Street – Peter Lynch

About:

A fun and practical book that shows how ordinary people can beat Wall Street pros just by observing the world around them.

Best For:

Retail investors, beginners who want to spot investment opportunities in daily life.

Key Idea:

“Invest in what you know” — good companies are all around you if you pay attention.

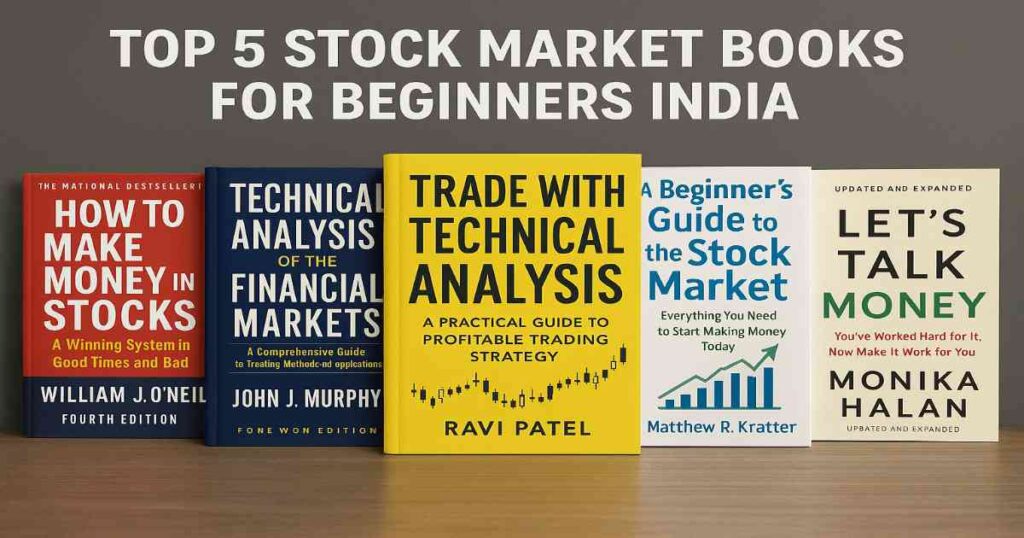

4. How to Make Money in Stocks – William J. O’Neil

About:

This book combines technical and fundamental analysis to teach the CAN SLIM strategy — a method to find high-growth stocks early.

Best For:

Those interested in short- to mid-term trading, chart analysis, and breakout stocks.

Key Idea:

Follow a system, use charts, and watch for high earnings growth + volume patterns.

5. The Little Book That Still Beats the Market – Joel Greenblatt

About:

This book offers a simple, rule-based strategy (called the Magic Formula) for picking winning stocks using just two metrics: return on capital and earnings yield.

Best For:

New investors who want a systematic way to invest without overthinking.

Key Idea:

Use math + logic to beat the market consistently over time.

All Book Table

| Book Title | Author | Focus Area | Best For |

|---|---|---|---|

| The Intelligent Investor | Benjamin Graham | Value Investing | Long-term, risk-averse investors |

| Common Stocks and Uncommon Profits | Philip Fisher | Growth Investing | Business-focused investors |

| One Up On Wall Street | Peter Lynch | Practical Stock Picking | Beginners, everyday investors |

| How to Make Money in Stocks | William J. O’Neil | Technical + Growth | Traders, momentum investors |

| The Little Book That Still Beats the Market | Joel Greenblatt | Magic Formula Strategy | New, logical-minded investors |

best book trading psychologya

Trading in the Zone by Mark Douglas. Often cited as one of the most influential books on trading psychology, Trading in the Zone by Mark Douglas explores the mental habits that limit investor performance — particularly those driven by fear and greed.

Which book is best for an option trading in Indian traders?

Futures & Options Blueprint: Beginner’s Guide to Derivatives | 15+ Option Trading Strategies, Calls, Puts, Option Chain, Greeks, Payoff Charts & Open Interest Explained | Zebra Learn Books

What is the best book for stock market as a beginner

Stock Investing Mastermind Beginners Handbook to Winning the Stock Market

stock market technical analysis books

Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

John J. Murphy has updated his landmark bestseller Technical Analysis of the Futures Markets, to include all of the financial markets. This outstanding reference has already taught thousands of traders the concepts of technical analysis and their application in the futures and stock markets. Covering the latest developments in computer technology, technical tools, and indicators, the second edition features new material on candlestick charting, intermarket relationships, stocks and stock rotation, plus state-of-the-art examples and figures. From how to read charts to understanding indicators and the crucial role technical analysis plays in investing, readers gain a thorough and accessible overview of the field of technical analysis, with a special emphasis on futures markets. Revised and expanded for the demands of today’s financial world, this book is essential reading for anyone interested in tracking and analyzing market behavior.

fundamental analysis of stocks books

Fundraising Decoded: For First Time Founders & Entrepreneurs | A Guide for Startup Founders on Navigating of Raising Capital, Venture Deals, Valuations, Investor Pitch Due Diligence | ZebraLearn Book

“Fundraising Decoded,” helps you throughout the fundraising process, decodes every single step, so that you can make informed decisions. Written by founders for founders. Starts with explaining the process to you, and then goes onto offering practical guidance on how to start the fundraising process, approach investors, pitch your idea, create an impactful pitch deck, create your financial projections, find the valuation of your company, and more. What 12 elements are a “must-have” for the deck Learn how to Pitch the investor in 15 mins? Create financial models on spreadsheets 11 Key Documents/Plans investors will ask What steps to get the money in your bank? “If building a startup is a roller-coaster ride, then fund-raising is a roller coaster in the dark – you don’t even know what’s coming!” ― Uri Levine, Raising funds is an essential milestone for most Startup founders, and this is often one topic where founders find themselves stuck. This is because the investing ecosystem is not as transparent as it seems. Founders are generally not aware of what investors are looking for, what difficult terms mean, how they should pitch their business and more. Based on real experiences, “Fundraising Decoded,” is a book that helps you throughout the fundraising process, decodes every single step, so that you can make informed decisions. The book starts with explaining the process to you, and then goes onto offering practical guidance on how to start the fundraising process, approach investors, pitch your idea, create an impactful pitch deck, create your financial projections, find the valuation of your company, and more. This book is best suited for first time founders, or anyone who is planning for a fundraise for the first time & helps them avoid the common mistakes that most founders make.

candlestick chart patterns books

A form of technical analysis, Japanese candlestick charts are a versatile tool that can be fused with any other technical tool, and will help improve any technician’s market analysis. They can be used for speculation and hedging, for futures, equities or anywhere technical analysis is applied. Seasoned technicians will discover how joining Japanese candlesticks with other technical tools can create a powerful synergy of techniques; amateurs will find out how effective candlestick charts are as a stand-alone charting method. In easy-to-understand language, this title delivers to the reader the author’s years of study, research and practical experience in this increasingly popular and dynamic approach to market analysis. The comprehensive coverage includes everything from the basics, with hundreds of examples showing how candlestick charting techniques can be used in almost any market.

Disclaimer

This content is for educational purposes only and should not be considered financial or investment advice. Stock market investments are subject to risks. Always do your own research or consult a qualified financial advisor before making any investment decisions. The author is not responsible for any financial losses arising from the use of this information.It is not intended as investment advice or a recommendation to buy or sell any securities.